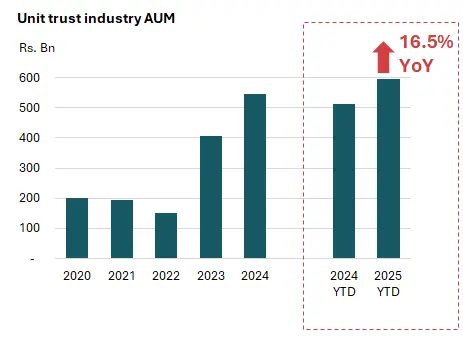

The unit trust industry of Sri Lanka reported a 16.5% year-over-year growth of its assets under management (AUM) to Rs. 597 Bn by the end of November 2025. These assets are currently managed across 85 funds by 16 management companies.

Industry AUM continues to be bolstered by strong inflows into equity-related funds, which recorded Rs. 3.4 Bn in new funds during the month. Additionally, the industry saw 2,945 new unit holders invest in the market in November, with a total of 27,720 new investors added year-to-date. This indicates a growing familiarity and acceptance of unit trusts as an alternative investment tool among investors. As of end-November, the total number of unit trust investors in the market stood at 141,252, up approximately 25.0% year-over-year.

Speaking recently of the unit trust industry, Chairman of the Securities and Exchange Commission of Sri Lanka (SEC) Prof. Hareendra Dissabandara spoke of the importance of unit trusts in deepening Sri Lanka’s capital markets by enabling wider public participation through accessible, well-regulated and professionally managed investment options.

“Unit trusts open the door for ordinary citizens — even those with small savings — to become investors. This builds financial inclusion, encourages savings to flow into productive investments, and ultimately strengthens our capital market and national economy,” he stated.

He further reiterated: “Every investment carries some risk, but unit trusts are one of the safest ways to invest in the market. They are regulated by the SEC and held under the custody of independent trustees — often banks — who ensure that your money is not misused. The funds are required to disclose their performance regularly, so investors can see how their money is growing. Transparency and accountability are built into the system.”

Commenting on the industry results, Vice President of the Unit Trust Association of Sri Lanka (UTASL) and CEO of First Capital Asset Management Limited Kavin Karunamoorthy noted: “We are extremely encouraged to see the upward direction the industry has been heading in this past year. However, we believe there is more to be done. With the recent success of our ‘Investor Awareness Initiative’ held in October, we continue to remain focused on strengthening financial literacy and investor participation across the country in unit trusts.”

He further added: “These efforts are carried out in collaboration with the SEC and Colombo Stock Exchange (CSE), and we believe the recently launched ‘A Share for Each – A Unit for Everyone’ national initiative by the SEC to promote the industry will help activate and grow the investor base further.”

The UTASL is the representative body for the country’s licensed fund management companies, dedicated to upholding the highest standards of professionalism, integrity and transparency across the industry. Consisting of 16 member companies regulated by the SEC, the UTASL aims to popularise unit trusts and encourage Sri Lankans to prioritise long-term and professionally guided investing, in addition to short-term savings, whilst contributing to national economic growth.